Using the PayPal Stablecoin, PayPal USD for Commerce

Jan 25, 2024

6 min read

In August 2023, PayPal announced the launch of PayPal USD (PYUSD), a U.S. dollar denominated stablecoin designed for payments. PYUSD is 100% backed by U.S. dollar deposits, short-term U.S Treasuries and similar cash equivalents and is redeemable 1:1 for U.S. dollars. PYUSD was launched as a standard ERC-20 token on the Ethereum blockchain.

In this post, we will explore what PYUSD is, how it works as an ERC-20 token, and how it can be used in commerce.

What is PYUSD?

PYUSD is issued by Paxos Trust Company, a fully licensed limited purpose trust company subject to regulatory oversight by the New York State Department of Financial Services. Reserves for PayPal USD are fully backed by U.S. dollar deposits, U.S. Treasuries and similar cash equivalents, and PayPal USD can be bought or sold through PayPal at a rate of $1.00 per PayPal USD. This means that the value of PYUSD remains constant relative to the value of the US dollar, making it an attractive payment option for merchants and customers alike. PYUSD can also be sent to friends in the US on PayPal and Venmo without fees.

PYUSD can be utilized not only within PayPal's own payment processing system but also on other platforms that support ERC-20 tokens, including various exchanges and wallets. For example, you can also transfer it on chain to and from Ethereum wallets that support PYUSD where network fees may apply. This versatility enhances its attractiveness as a digital payment method in the evolving financial landscape.

How does PYUSD work as an ERC-20 token?

PYUSD is built using Ethereum's ERC-20 standard, which is a widely used standard for creating and managing tokens on the Ethereum network. The ERC-20 standard provides several benefits that make it an attractive option for stablecoins.

One of the key benefits of the ERC-20 standard is its interoperability with various platforms and exchanges. This feature simplifies the process of incorporating PYUSD into smart contracts and facilitates easy acceptance of PYUSD payments. Customers also benefit from straightforward access to their funds across different platforms, enhancing their financial flexibility. Additionally, because PYUSD adopts the ERC-20 standard, it has been integrated into popular wallets. This widespread compatibility ensures that PYUSD is readily accessible and user-friendly, making it a preferred option for both merchants and customers in digital transactions.

The ERC-20 token standard primarily relies on three functions to perform transfers on the blockchain; the transfer, the approve, and the transferFrom functions. The PYUSD smart contract is deployed on the Ethereum mainnet blockchain at 0x6c3ea9036406852006290770BEdFcAbA0e23A0e8.

The transfer(recipient, amount) function allows the caller to move the specified amount of PYUSD from their address to the recipient’s address. This function can be called by crypto wallets to initiate a transfer.

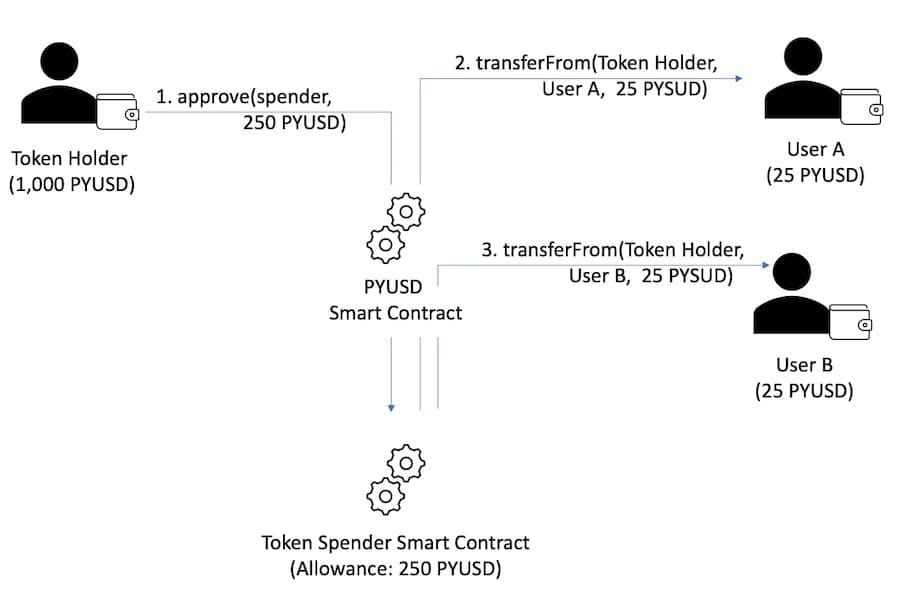

Below, we will see how the approve and transferFrom functions can be used to move PYUSD on the blockchain. This combination of functions can be used by smart contracts to enable complex payment flows like micropayments or recurring payments, etc.

The approve(spender, amount) function allows the token holder (caller of this function) to grant permissions, an allowance, to another account, the spender in this case to transfer a specified amount of PYUSD on their behalf.

Once the token holder has granted the spender an allowance, the latter can use the transferFrom(sender, recipient, amount) function to move the PYUSD from the token holder to another address. The recipient may be the spender’s account or another account as shown below. The allowance can be spent in one transaction or multiple smaller transactions. This is a great way to enable micro-payments, for example.

In the above diagram, in step 1, we see that the Token Holder has provided Token Spender smart contract an allowance of 250 PYUSD. This means that the Spender, can at some point in the future, transfer 250 PYUSD from the Holder’s account.

In step 2, we see that the Spender has initiated a transferFrom from the Holder to User A of 25 PYUSD. At this point, the Spender will have a remaining allowance of 225 PYUSD.

In step 3, the Spender initiates another transferFrom from the Holder to User B of 25 PYUSD. Now the Spender will have a remaining allowance of 200 PYUSD that can be transferred at some point in the future.

How can PYUSD be used in commerce?

PYUSD can be used in a variety of ways in commerce, including online payments, point-of-sale payments, and other financial transactions.

Here are some examples of how PYUSD can be used:

1. Online Payments and Point-of-Sale (POS) Payments: PYUSD can be used as a payment option on e-commerce platforms and POS terminals, enabling merchants to accept payments from customers in a reliable and secure manner. This provides merchants with an attractive lower cost alternative to traditional payment methods and allows customers to access and spend their funds easily.

2. Financial Transactions: PYUSD can be used for a variety of financial transactions, including paying invoices, sending and receiving payments, transferring funds between accounts, and investing in various assets by leveraging the programmability of PYUSD via smart contracts.

3. Decentralized Applications (dApps): dApps that are built on the Ethereum network can use PYUSD as a payment option, enabling users to make purchases and transactions with the stablecoin within the dApp's ecosystem.

If you want to include PYUSD in your dApp, wallet or other application, you can find more information in the developer documentation, including logo files and PYUSD contract details.

PYUSD, leveraging Ethereum's ERC-20 standard, offers a robust and versatile solution for merchants and web3 developers, endorsed by PayPal's trusted brand. It provides a secure and reliable platform for digital transactions, ideal for a range of uses from supporting personal transfers to facilitating international payments. This integration not only streamlines payment processes but also significantly advances the adoption and functionality of digital assets, harnessing blockchain technology for efficient, cost-effective financial interactions in the digital economy.

This article shouldn’t be taken as financial, investment, or tax advice. Crypto services may be subject to limitations and conditions under applicable law. Terms Apply.

Recommended

Managing Recurring Payments with Apple Pay Using PayPal

4 min read

Why You Should Attend PayPal’s Developer Meetup at Money20/20

4 min read

Building a Customizable Messaging Platform

10 min read